The main reason for an ira llc operating agreement is to satisfy the ira custodian. An operating agreement for a llc should contain special provisions applicable to an ira and a standard or template agreement do not contain these provisions.

A copy of the operating agreement that is prepared by a qualified entity will be required by the ira custodian of your self directed ira and also by the bank where you will have your llcs checking account.

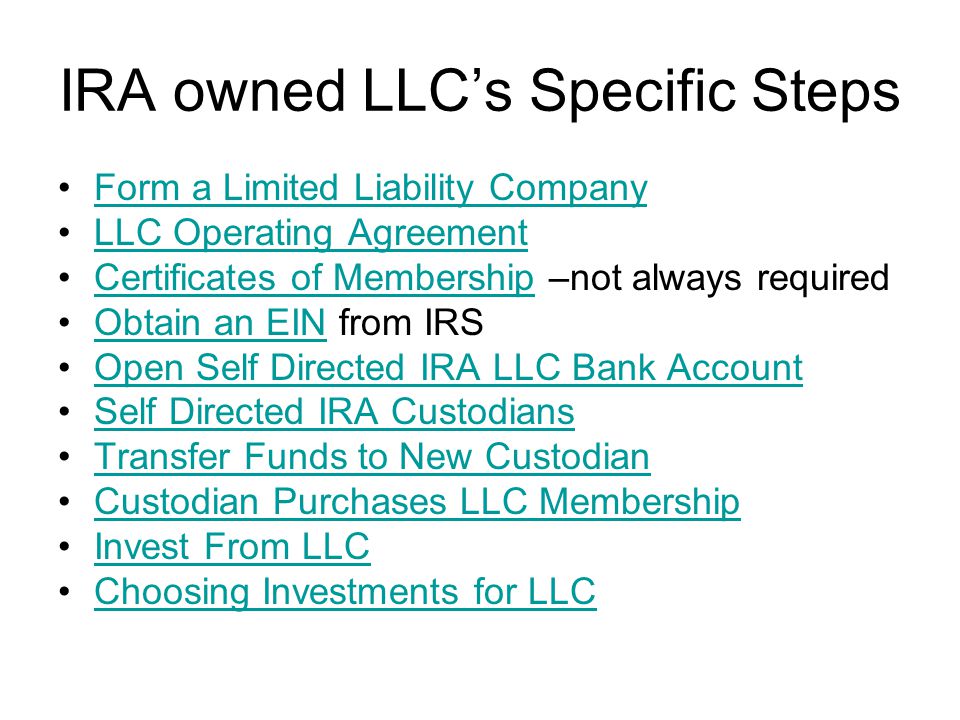

Self directed ira llc operating agreement template. First tuesdays llc operating agreement for self directed ira is designed to meet custodians requirements for sdira llcs. For an ira owner it becomes a boilerplate form to easily assist in the creation of the llc. Form a self directed ira llc and get a self directed ira llc operating agreement.

We hope this information is helpful in your due diligence process. They will not draft one for you or provide much guidance and they wont accept a standard llc operating agreement. The llc operating agreement is the most important document for your llc.

Just complete a short form with your llc information and receive your operating agreement in less than 24 hours. Self directed ira llc record book sample click the download button for a sample ira llc record book which includes a sample operating agreement and llc governance documents. Remember that self directed ira custodians are best at covering their a and you cant blame them for that.

We are a bbb accredited business rated a with years of experience. The presence of an llc within a self directed ira 401k sep or simple ira imposes a number of other requirements on your llc operating agreement as well. The llc cannot pay salary fees or wages directly to anyone who is an owner of the self directed ira nor to anyone who is a disqualified person.

Investment advisory agreement template beautiful sample consultant from self directed ira llc operating agreement example source. It is generally required by a self directed ira custodian and required to open a bank account in the name of the llc. The self directed ira operating agreement the llc operating agreement is the core document that is referred to when issues concerning the llc need to be resolved.

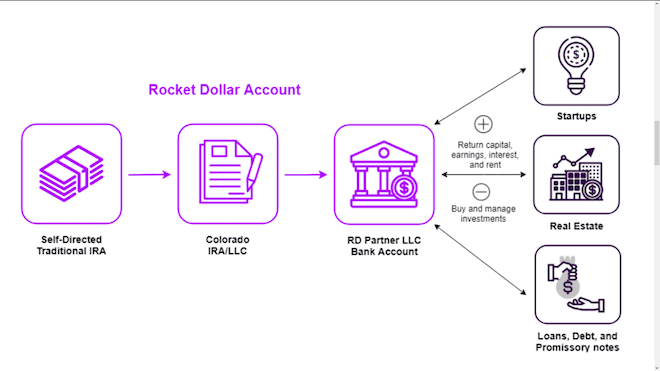

If necessary transfer funds from your current custodian financial institution to a new custodian that allows self directed ira investments. Self directed ira llc will provide you with a complete customized custodian approved ira llc operating agreement within 24 hours of receiving your order. Direct the custodian to transfer the ira funds to your new self.

An operating agreement helps your llc by guarding your limited liability status.

0 Response to "Self Directed Ira Llc Operating Agreement Template"

Post a Comment