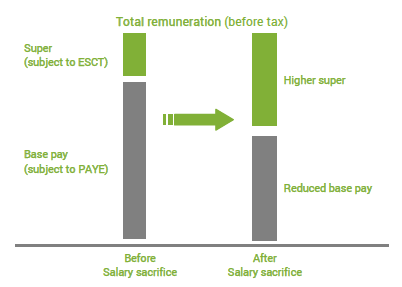

A on the expiry date. The caps for 2019 20 financial year on before tax contributions for any age is 25000 per year including superannuation guarantee contributions made by your employer.

Salary in your super account gets taxed at 15 if you earn less than 250000 or 30 if you earn more than 250000.

Superannuation salary sacrifice agreement template australia. The sacrificed component of your total salary package is not counted as assessable income for tax purposes. Account number customer number if known contact telephone number business hours title first name mr mrs miss ms other middle name family name date of birth ddmmyyyy email. Sharons salary only comprises ote amounts.

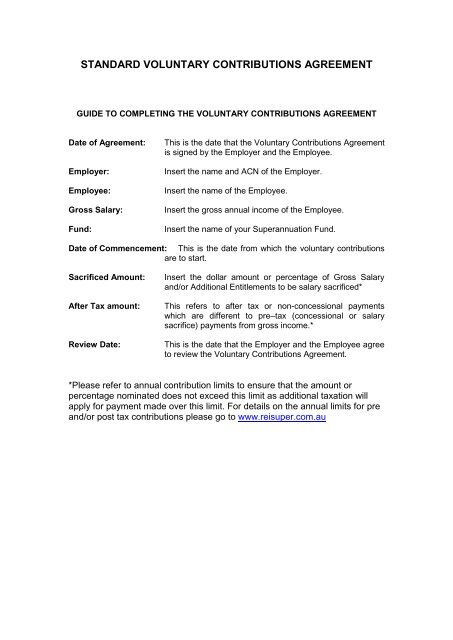

Gst exclusive gst total note. C at any time by written agreement between the parties d on the date that the employees employment with the employer ends. This authority is an agreement between the employer and employee.

This is an amount on top of your employers compulsory superannuation guarantee payment 95 of your salary. Sharons employer previously calculated his sg liability on sharons after salary sacrifice wage as follows. If you make super contributions through a salary sacrifice agreement these contributions are taxed in the super fund at a maximum rate of 15.

Agreement to salary sacrifice an eligible item. All salary sacrifice arrangements must be the subject of a written agreement between healthcare australia and the employee in the form of a salary sacrifice super request form which must include. Sam earns 65000 a year and is considering entering into an effective salary sacrifice arrangement.

Under this arrangement his employer will provide the use of a 35000 car and pay all the associated running expenses of 11500. Sharon earns 2000 a week and has an effective salary sacrifice agreement with her employer to sacrifice 250 to her superannuation fund each week. Section 1 staff member details employee id essential family name given names divisionportfoliounit schoolunit section 2 claim details.

A valid tax invoice proof of payment must be attached to this form. Termination 101 this salary sacrifice agreement shall expire and terminate. Australia ltd abn 66 006 818 695 afsl 235249 the trustee of health employees superannuation trust australia hesta abn 64 971 749 321.

It helps you save money in two ways. Mlc superannuation salary sacrifice 1 of 1. Or b on the expiry or termination of the principal agreement.

2000 250 1750. You pay less tax. Generally this tax rate is less than your marginal tax rate.

A statement that the arrangement proceeds only from the request of the employee that the agreement be made 2.

0 Response to "Superannuation Salary Sacrifice Agreement Template Australia"

Post a Comment