On completing the cliff period the staff receives full benefits. Google and ye shall find.

In the netherlands vesting also does not exist legally according to our lawyer.

Shareholders agreement template with cliff vesting schedule. The agreement should. The one year cliff means that the founders will not get vested with regards to any shares until the first anniversary of the founders stock issuance. This agreement outlines when or how the vesting shares will vest with the employee or key person.

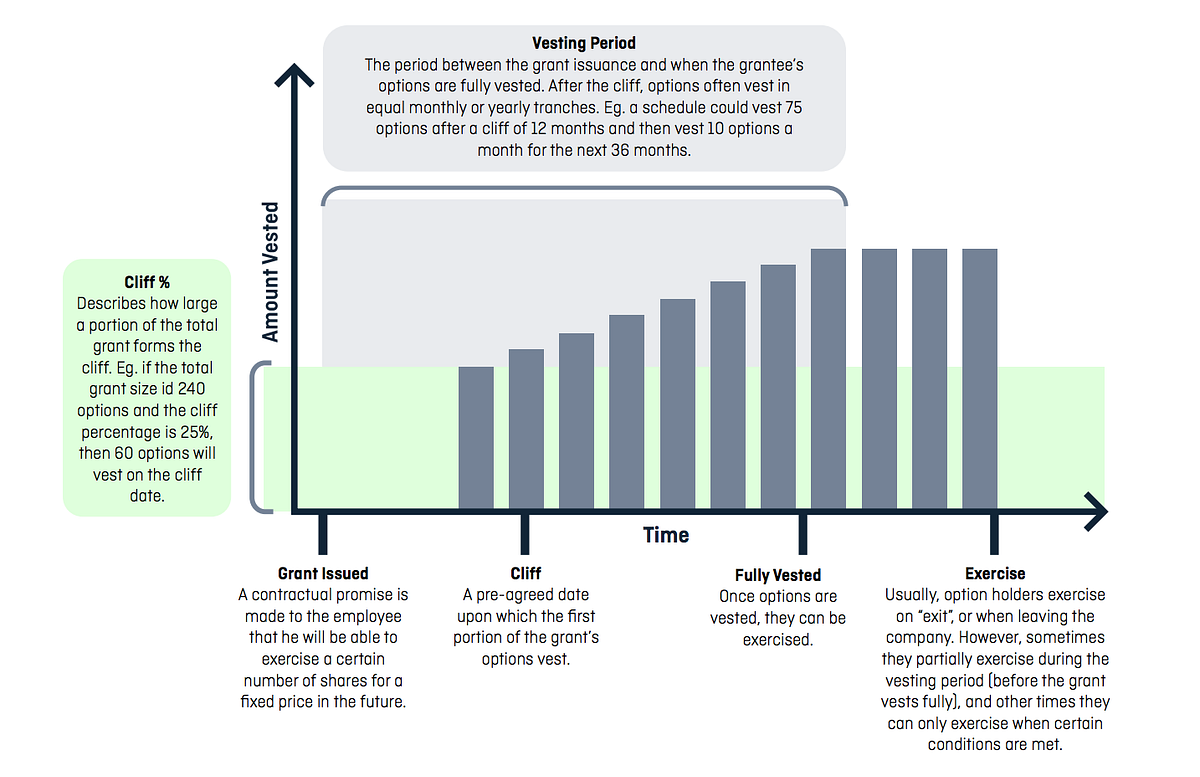

Four years with a one year cliff is the typical vesting schedule for startup founders stock. How do vesting shares work. Companies are trying to automate them etc.

You need an experienced pilot. How we solved it in our shareholder agreement is that you have to sell the non vested portion of your shares at an early exit for 1 euro back to the other founders you can keep your vested shares or sell them at a real market value. The most common options vesting package spans for four years with a one year cliff.

Agree a new vesting schedule and an updated purchase price. In most cases it is usually a four year vesting schedule plan with a one year cliff. Template co founder agreement.

There should be a vesting schedule contained in either the shareholders agreement or a share vesting agreement. Founders agreement template with vesting this template is provided as a general guide to pre incorporation business associations. It is very important to mention the vesting period of the shares.

If the founder of the company is given shares for vesting the terms of the agreement can be found in the shareholder agreement and if an employee has been offered shares for vesting the terms are available under the employee contract. Suppose an employee receives shares to be vested over a period of. To protect a startups assets and equity and ensure employees are rewarded for their sustained valuable contribution a share vesting agreement or vesting schedule should be one of the first documents you have drafted.

Generally employers issue vesting shares to employees up front. It allows people to collaborate on speculative early stage business projects on fair terms without a lot of hassle or paperwork. I liken the documents to an airplane.

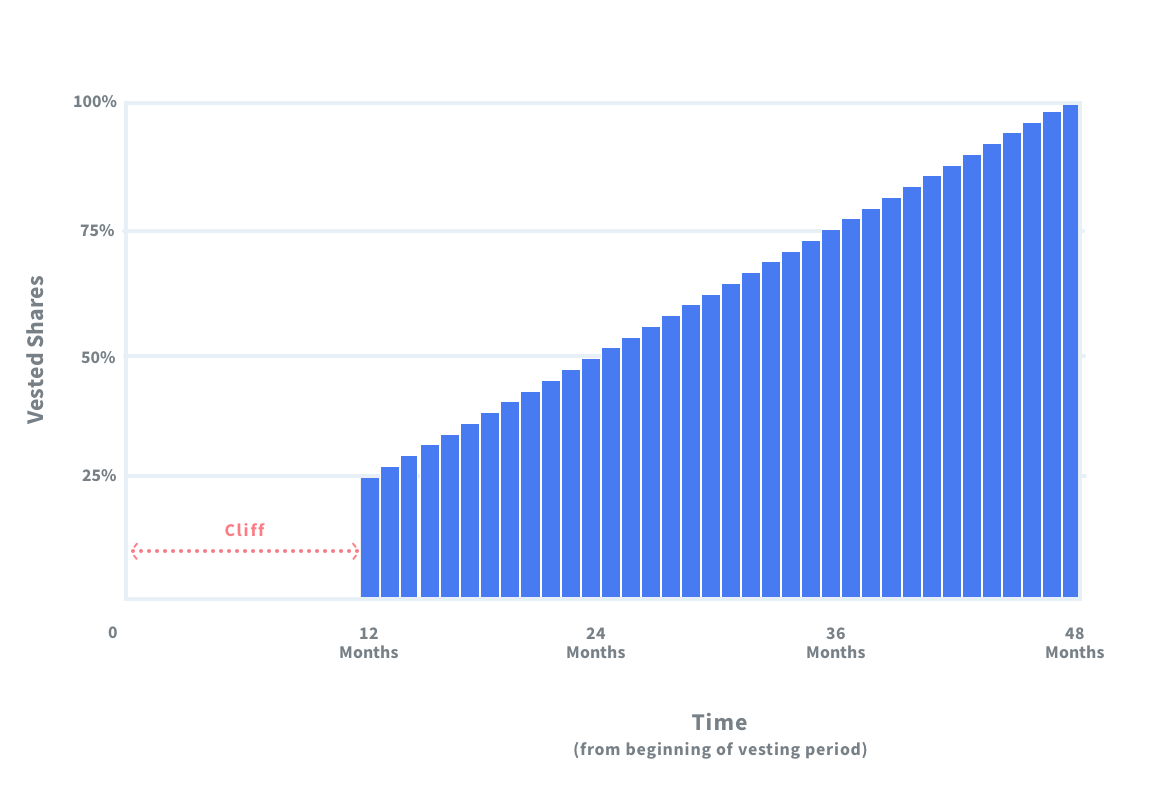

Cliff vesting is a process where employees are entitled to the full benefits from their firms qualified retirement plans and pension policies on a given date. Law firms post them. These are readily available online.

It should also have a payment schedule of the purchased price of assets bought. Shareholders agreement see the governance section of the templates page of our website. Founders using this document will need to ensure that their companys constitution.

Examples of shares vesting. Under this vesting schedule founders will vest their shares over a total period of four years. You should be the passenger.

Prepare an informative and generally accepted shareholder agreement using this shareholder agreement template that is mentioned above. Can be done easily.

0 Response to "Shareholders Agreement Template With Cliff Vesting Schedule"

Post a Comment